Child Tax Benefit Increase 2024 – A new tax bill aims to increase access to the child tax credit for lower-earning families — but it’s much less generous than it was in 2021. . Here’s how a proposed change in the rules for the child tax credit impact tax refunds and the upcoming tax season. .

Child Tax Benefit Increase 2024

Source : in.pinterest.com

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

investingdrone Financial News, Retirement, Benefits, Student

Source : in.pinterest.com

New Expanded Child Tax Credit Proposed: Who Would Benefit? | Money

Source : money.com

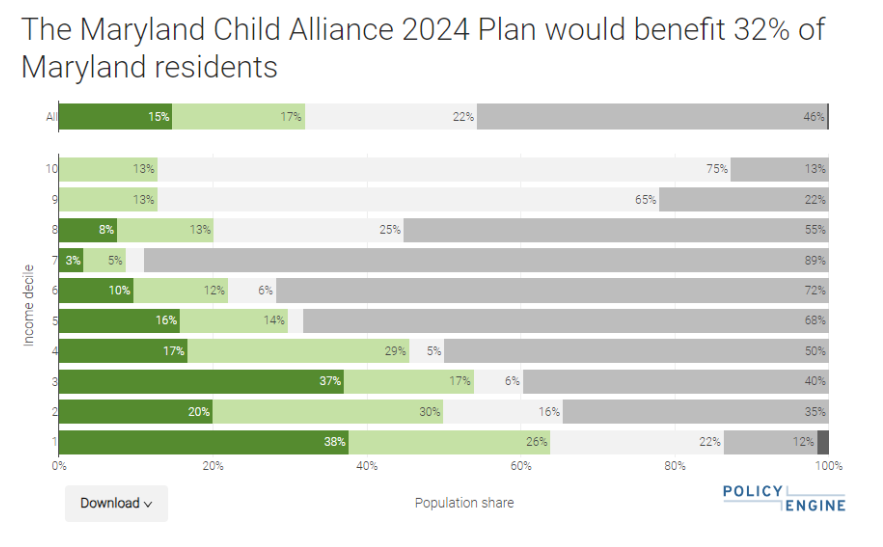

Announcing the Maryland Child Alliance 2024 Legislative Plan

Source : medium.com

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

More states will offer bigger child tax credits in 2024 : NPR

Source : www.npr.org

USA Child Tax Credit 2024 Increase Form : Apply Online & Claim

Source : www.sarkariexam.com

How much the child tax credit could increase in 2024 and what it

Source : www.washingtonpost.com

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

Child Tax Benefit Increase 2024 investingdrone Financial News, Retirement, Benefits, Student : The American Rescue Plan Act of 2021 expanded the tax credit by increasing the value of the minimum credit making the Covid-era expansion permanent argue that it will benefit 16 million children, . The utmost refundable portion of the CTC is projected to increase from the current $1,600 per child to $1,800 in 2023, $1,900 in 2024, and $2,000 in 2025, according to the framework. .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)